Business Valuation

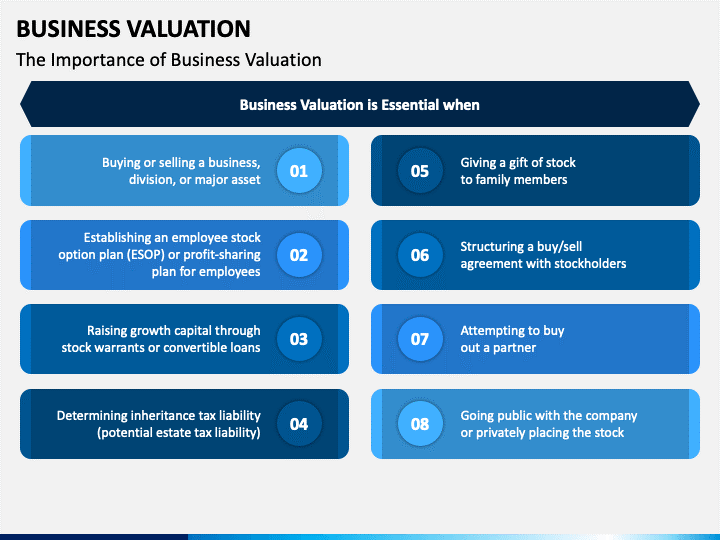

A business valuation, also known as a business appraisal, are obtained for many reasons. Some owners need a business valuation to obtain financing, others may need to determine a sale price because they are considering a sale of all, or a portion of, their business. Other reasons for a business appraisal are estate tax or gift tax, transferring shares of stock to family members, Employee Stock Ownership Plans, buyout of other business owners, purchase price allocations, estate planning, legal matters where the parties or the courts require a valuation, expert testimony/litigation support, or many other possible reasons.

The Uniform Standards of Professional Appraisal Practice (USPAP) published by The Appraisal Foundation, was adopted by Congress in 1989 as the appraisal standards for the United States. USPAP is the recognized ethical and performance standard for appraisals, including business appraisals, for the appraisal profession. Although other organizations and appraisers may use other appraisal standards, USPAP are the sole standards adopted by congress for appraisals in the USA.

Westwood-Benson business appraisals are based on the Uniform Standards of Appraisal Practice (USPAP) for the type of appraisal being prepared. Business Valuations prepared by these standards ensure that business values obtained will be as accurate as possible. Our certified business appraisals prepared by these standards are accepted by banks, CPA’s, Internal Revenue Service, lawyers, and state and federal courts.

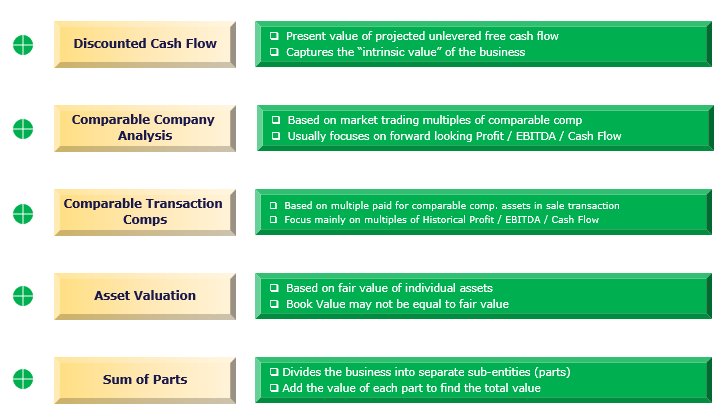

There are several business appraisal methods used to valuate a business. The most common methods are:

Asset Based Approach

Market Value Approach

The above valuation approaches represent those most commonly used, not all are utilized for every business appraisal. The appraiser will use a variation of the above approaches, or a specialized approach not listed above if the appraisal assignment warrants it. The business appraiser will review each of the approaches to value as they apply to the business enterprise being valued and make a determination as to which approach(s) should be used. Once an appraiser has selected the methods to be used, the conclusion of value will be based on the most appropriate method, or a combination of methods, to arrive at the most relevant conclusion of business value for the business being valued.

Westwood-Benson business appraisals will document relevant facts relating to the business valuation process including the identification of valuation methods, sources of information including financial information utilized, calculations used in determining value and other information and data relevant to the valuation.

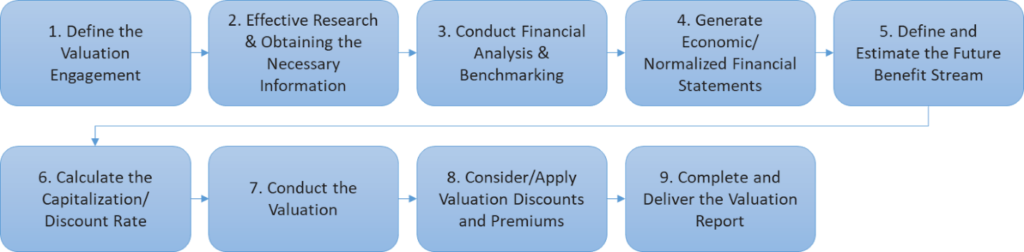

The business valuation process varies based on the purpose of the appraisal, the industry the subject business is in, the size of the company, and other factors. The following chart depicts the steps common to most business valuations:

Factors Affecting Private Business Value

The following critical factors have an effect on business value:

Revenue consistency and revenue trends plays a key role in valuations. Companies with a history of consistent revenue growth will be valued higher than similar companies not exhibiting the same levels of growth and/or revenue consistency.

Overall profitability, commonly defined by Net Income and Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA), go hand-in-hand with revenues. As is the case with revenues, businesses with consistent and increasing Net Income and EBITDA will bring the highest enterprise value among their peers.

Profits margins indicate the efficiency and other competitive advantages a company has. Competitive advantages often come from effective distribution channels, unique offerings and efficiency in production and operating capabilities. High profit margins will equate to a higher company value. There are often profit margins calculated for numerous aspects of a business and may be determined for specific products, departments and many other components of a business. The primary profit margin calculations utilized in business valuations are gross profit margins, net profit margins and EBITDA margins.

Industry sustainability is defined as probability that an industry will continue to show growth and be viable for the foreseeably future. As an example, when computers and printers become more affordable and started growing rapidly, the demand for typewriters declined, and the once large typewriter industry started a steady decline. The demand for typewriters was no longer sustainable. Another example was the decline of Eastman Kodak when photography largely shifted from film to digital. As a result of this shift, digital cameras and memory cards became a growth industry and the photography film and film developing business declined greatly.

Industry or concentration is the portion of a company’s sales coming from each industry in which the subject company provides products or services to. If all of a company’s sales are to customers in one specific industry, the company would have a high industry concentration. The other end of the spectrum is a company that derives its sales from many industries, and therefore, having a low industry concentration. Generally speaking, a company having a low industry concentration would be considered less risky and less subject to reduced sales if there were to be a downturn in a single industry.

Customer concentration refers to portion of a company’s sales attributable to each customer. A high customer concentration would refer to a company with a large percentage of its income coming from small number of customers. Having many customers with no one customer representing more than 10% of revenue is generally considered to be low customer concentration. Low customer concentration generally equates to higher business value.

When selling a business, there are ways to address high industry concentration, or high customer concentration, so the impact is minimized.

It’s been said that the best management teams have great depth. First and foremost, a good management team has a well thought out strategic plan. They know where they want to take the company and they have a well-conceived plan on how to execute the plan. When it comes to a good management team, it doesn’t matter whether the company is a large one or a small one. A smaller company will have a smaller management team but will be able to be more agile and focused. A small business with a great management team and vision, can grow very quickly.

A larger company will have a larger management team, often with multiple departments and layers of management. Regardless of the business size, companies with a well thought out business plan, and competent personnel in place to execute the plan, will be considered to have the highest business value.

Competitive advantage comes from having unique or exclusive products or services, or having the ability to provide products or services a lower cost than can be offered by competitors.

The most important aspect of a business valuation is its accuracy. If the time and attention to detail is put into a business appraisal report by an experienced appraiser, the end product will be of value. An improperly prepared report will be misleading and serve no purpose. Westwood-Benson business valuations are accepted by lenders, state and federal courts, the IRS, estate planners, attorneys, accountants, and are widely accepted as the industry standard.

Westwood-Benson staff will be pleased to answer any questions about our business valuations and will provide a written quote for our business appraisal services.